California leads the nation in residential solar photovoltaic

installations. In fact, nearly half of all systems installed have been

in the Golden State. So why is California the leader? Sure,

California has plenty of sunshine, but there are many other states that

can compete on that dimension, including Florida, the Sunshine State.

It’s not the federal tax benefits, which are available to all US

residents. It’s not California’s Renewables Portfolio Standard, which

effectively excludes residential solar.

Some point to the California

Solar Initiative that gave rebates for new systems from 2007 to 2013,

and that is surely part of it. But another factor is the “solar

friendly” residential electricity prices. Not only do California’s two

largest utilities have some of the country’s highest average residential

electricity prices, the rates are also tiered, meaning that they

increase for additional kilowatt-hours as the household consumes more

over the month. As a result, large users face rates for much of their

power that can be three times higher than rates in many other states,

including the Sunshine State.

Have

the level and structure of retail rates been a major factor in

California’s residential PV boom? I’ve been wondering that for a while,

so in the last few months I’ve been sizing up the various solar

incentives for customers of Pacific Gas & Electric, the state’s

largest utility, which has by far the most residential rooftop solar

capacity in the country. The result of this work is being released

today in a new Energy Institute working paper, “The Private Net Benefits of Residential Solar PV: And Who Gets Them”.

Using

data on PG&E households that installed solar from 2007 to 2013 (and

for some data, into early 2014), I examine the collection of incentives

that were available, whether the system was bought by the homeowner or

owned by a solar company, known as third-party owners (TPOs). TPOs can

lease the panels to the homeowner or agree to sell the electricity the

panels generate under a power purchase agreement that specifies the

price per kilowatt-hour (kWh), usually for 20 years. I then put all

these incentives together with reported prices of the systems to

calculate the net benefits. The incentives include direct rebates

and tax credits, as well as indirect incentives from the structure of

retail tariffs and the credit for electricity grid injections from the

panels under “net metering” policies, as I’ve discussed in an earlier blog.

To

start with the easiest ones, the California Solar Initiative was

offering $2.50 per watt rebates back at the beginning of this period –

when the full systems cost around $10 per watt on average. The CSI

rebate stepped down over time, eventually hitting $0.20/watt in 2013

just before it disappeared. In the first half of 2014, the average full

system price was down to around $4.50/watt.

If

you bought the system, you got the CSI rebate. With a TPO, the company

that owns the system got the rebate and — I hope — you got a lower

price reflecting at least part of that savings. In either type of

transaction, how much the price adjusted to pass through the savings to

the homeowner, or how much the installer captured, is a point of strong

dispute. Different analyses have estimated 17%, 45% and 99% passthrough

rates to homeowners. Unfortunately, my study can’t unpack that even in

the simple case of system purchases, let alone with much more complex

lease or power purchase agreements. I estimate the incentive the

homeowner and seller jointly received, not how they divided it up.

At

the same time as California had the CSI, the federal government was

giving a 30% tax credit for solar, but only up to $2000 for the entire

system if a homeowner bought it in 2007 or 2008. TPOs got the full

credit from the start. Since 2009, homeowners have also had no cap on

the tax credit.

If you think figuring out federal tax credits

could get a bit tedious, imagine the thrill of analyzing the economics

of accelerated depreciation. I’ll spare you the details here (a phrase

that may have been more welcome a couple paragraphs earlier), but the

bottom line is that accelerated depreciation — which only TPOs can

utilize — amounted to an additional 12%-15% incentive, about half the

size of the 30% federal tax credit, and larger than the CSI since 2010.

The figure below shows my estimates of the size of these incentives,

all per kW of installed capacity, from 2007-2013.

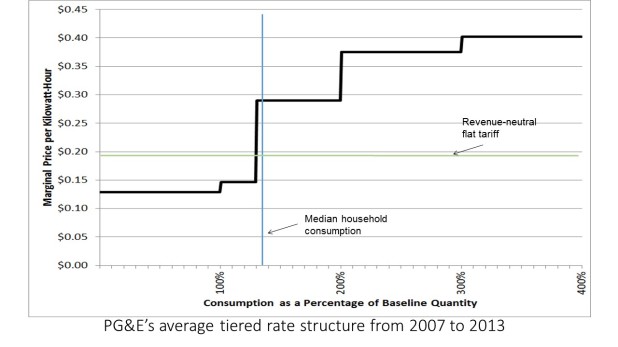

That

brings us to the incentive from residential rates. During the period I

studied, the 5 tiers of PG&E’s rate structure averaged $0.13,

$0.15, $0.28, $0.37, and $0.40 per kilowatt-hour (kWh). The solar PV on

your rooftop crowds out the most expensive kWh first by reducing the

total kWh for which you get billed. Over these years, the systems

installed were on average displacing kWhs that would have cost the

customer an average of about 26 cents. Importantly, that is much higher

than the 19 cents per kWh they would have saved if PG&E charged a

single flat rate for electricity (that raised the same revenue). If PV

adopters expected the tiered prices to stay at those levels (adjusted

for inflation), I show that PG&E’s tiering of rates created nearly

as much additional incentive to install solar as did the 30% federal tax

credit.

The savings are so large in part because of net energy

metering (NEM), which means the household only pays for the net

consumption — that is, total consumption minus the electricity the

panels produce — even if some of the panel production gets injected into

the grid (which happens any time that the household consumption is

lower than production). An alternative approach, used in other parts of

the world, is to pay the household a lower price for grid injections

than the retail price the household pays for receiving electricity.

Surprisingly — at least to me — moving from NEM to that alternative

approach, but keeping the same tiered rates, would reduce the incentive

for solar by only about half as much as moving from tiered to a flat

electricity rate. The steep tiers create a much larger incentive than

NEM, though the combination creates a still larger incentive.

Important note:

those steep tiers created strong incentives only if they were expected

to last. Maybe they were, but they didn’t. Already, in 2015, the

lowest tier prices have risen and the highest have fallen so much that

the highest tier price is now about twice the lowest rather than three

times. Proposals now before the California Public Utilities Commission

would change the spread to just 20% or 66% depending on which proposal

is adopted. This will further lower the average price of electricity

that the solar panels replace, and lower the incentive for large users

to install PV.

Beyond the size of these incentives, I also

wondered who was going solar, particularly how much the recipients of

incentives tilt towards high-income households. Using very granular

census data, I estimated household incomes for each PG&E customer

who installed solar. Not surprisingly, they are heavily skewed to the

wealthy with 35%-40% of systems going to households in the top 20% of

earners. But that has been changing since 2011, with the measure of

inequality among adopters declining by nearly one-fifth from 2010 to

2014. In the first few months of 2014, households in the highest of the

five income brackets were still 82% more likely to adopt solar than

households in the middle bracket, but that’s down from 116% in 2010.

Estimating

incomes of solar adopters also give some insight into how the private

benefits vary among those who do install PV systems. As you would

expect, the lower income adopters tend to consume less electricity and

put in smaller systems, but they actually put in larger systems relative

to their consumption. That means they start lower down on the tiered

rate structure and they crowd out a larger share of kWh, which are kWh

that wouldn’t have cost that much anyway. Systems on the roofs of the

highest income bracket households crowded out electricity that would

have cost them 27 cents per kWh on average, while the systems on middle

income households displaced 25 cent power, and the households in the

lowest bracket displaced 21 cent electricity on average. Among those

who installed solar in 2007-14, the wealthiest customers were likely to

get the largest savings.

As I wrote a few weeks ago,

we need a careful analysis of the societal costs and benefits of

deploying renewable power at grid scale versus distributed generation.

At the same time, we also need a careful analysis of the incentives that

have been created for generating energy from all sources. Regardless

of one’s views on solar, distributed generation, or renewables

generally, understanding the size of the financial incentives from

direct and indirect factors is critical to evaluating which programs are

likely to have the greatest effect on adoption and which customers are

likely to get the greatest benefits.

http://theenergycollective.com/severinborenstein/2232516/what-put-california-top-residential-solar