By Gail Tverberg

Some people talk about peak energy (or oil) supply. They expect

high prices and more demand than supply. Other people talk about energy

demand hitting a peak many years from now, perhaps when most of us have

electric cars. Neither of these views is correct. The real situation is that we right now seem to be reaching peak energy demand through low commodity prices. I see evidence of this in the historical energy data recently updated by BP (BP Statistical Review of World Energy 2015). Of course,

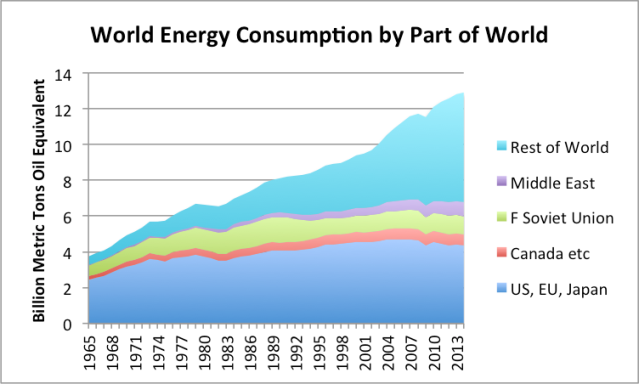

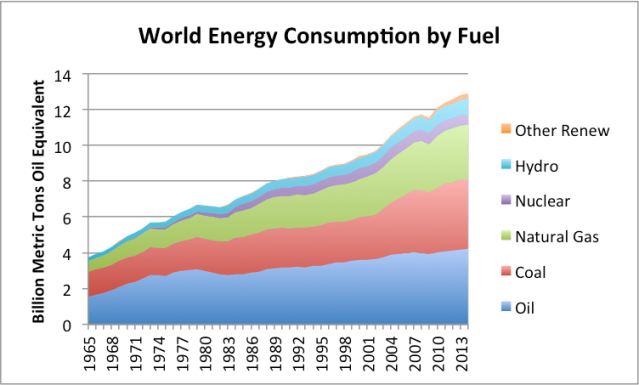

Growth

in world energy consumption is clearly slowing. In fact, growth in

energy consumption was only 0.9% in 2014. This is far below the 2.3%

growth we would expect, based on recent past patterns. In fact, energy

consumption in 2012 and 2013 also grew at lower than the expected 2.3%

growth rate (2012 – 1.4%; 2013 – 1.8%).

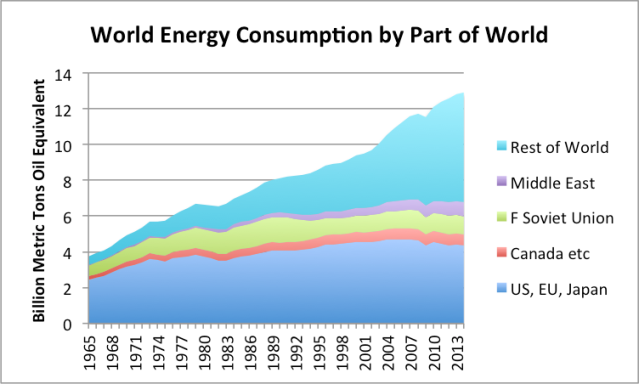

Figure

1- Resource consumption by part of the world. Canada etc. grouping also

includes Norway, Australia, and South Africa. F Soviet Union means

Former Soviet Union. Middle East excludes Israel. Based on BP

Statistical Review of World Energy 2015 data.

Figure

1- Resource consumption by part of the world. Canada etc. grouping also

includes Norway, Australia, and South Africa. F Soviet Union means

Former Soviet Union. Middle East excludes Israel. Based on BP

Statistical Review of World Energy 2015 data.

Recently,

I wrote that economic growth eventually runs into limits. The symptoms

we should expect are similar to the patterns we have been seeing

recently (Why We Have an Oversupply of Almost Everything (Oil, labor, capital, etc.)). It

seems to me that the patterns in BP’s new data are also of the kind

that we would expect to be seeing, if we are hitting limits that are

causing low commodity prices.

One of our underlying problems is

that energy costs that have risen faster than most worker’s wages since

2000. Another underlying problem has to do with globalization.

Globalization provides a temporary benefit. In the last 20 years, we

greatly ramped up globalization, but we are now losing the temporary

benefit globalization brings. We find we again need to deal with the

limits of a finite world and the constraints such a world places on

growth.

Energy Consumption is Slowing in Many Parts of the World

Many parts of the world are seeing slowing growth in energy consumption. One major example is China.

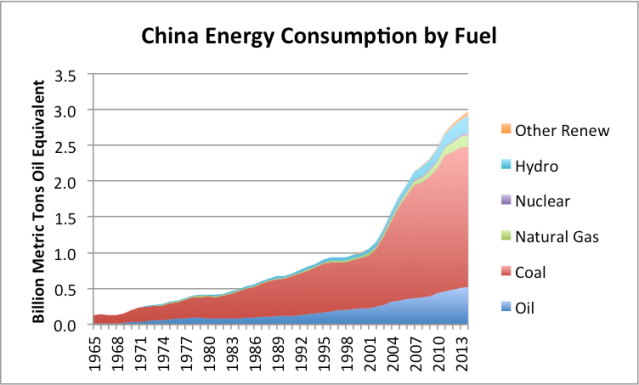

Figure 2. China’s energy consumption by fuel, based on data of BP Statistical Review of World Energy 2015.

Figure 2. China’s energy consumption by fuel, based on data of BP Statistical Review of World Energy 2015.

Based

on recent patterns in China, we would expect fuel consumption to be

increasing by about 7.5% per year. Instead, energy consumption has

slowed, with growth amounting to 4.3% in 2012; 3.7% in 2013; and 2.6% in

2014. If China was recently the growth engine of the world, it is now

sputtering.

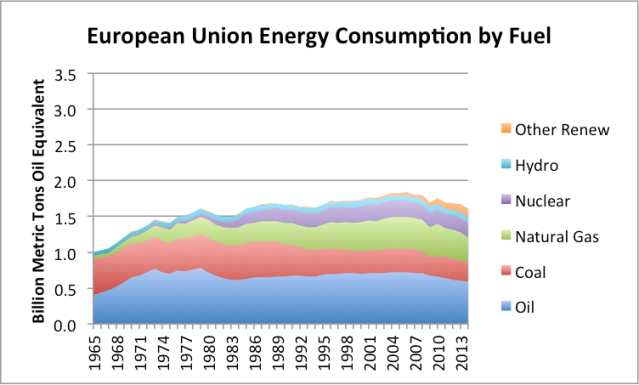

Part of China’s problem is that some of the would-be

buyers of its products are not growing. Europe is a well-known example

of an area with economic problems. Its consumption of energy products

has been slumping since 2006.

Figure 3. European Union Energy Consumption based on BP Statistical Review of World Energy 2015 Data.

Figure 3. European Union Energy Consumption based on BP Statistical Review of World Energy 2015 Data.

I

have used the same scale (maximum = 3.5 billion metric tons of oil

equivalent) on Figure 3 as I used on Figure 2 so that readers can easily

compare the European’s Union’s energy consumption to that of China.

When China was added to the World Trade Organization in December 2011,

it used only about 60% as much energy as the European Union. In 2014, it

used close to twice as much energy (1.85 times as much) as the European

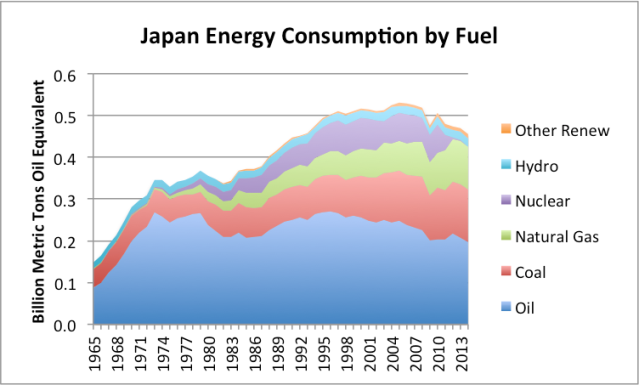

Union. Another area with slumping energy demand is Japan. It

consumption has been slumping since 2005. It was already well into a

slump before its nuclear problems added to its other problems.

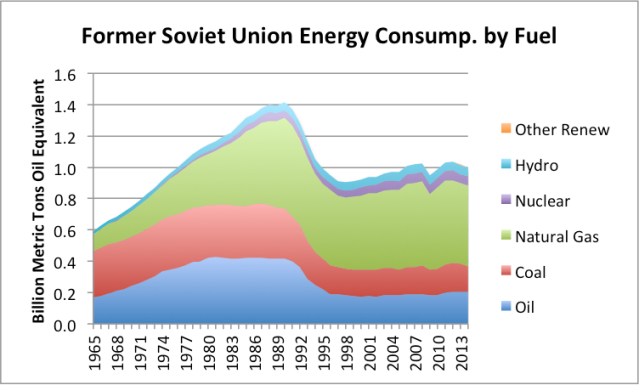

A

third area with slumping demand is the Former Soviet Union (FSU). The

two major countries within tithe FSU with slumping demand are Russia and

Ukraine.

Figure 5. Former Soviet Union energy consumption by source, based on BP Statistical Review of World Energy Data 2015.

Figure 5. Former Soviet Union energy consumption by source, based on BP Statistical Review of World Energy Data 2015.

Of

course, some of the recent slumping demand of Ukraine and Russia are

intended–this is what US sanctions are about. Also, low oil prices hurt

the buying power of Russia. This also contributes to its declining

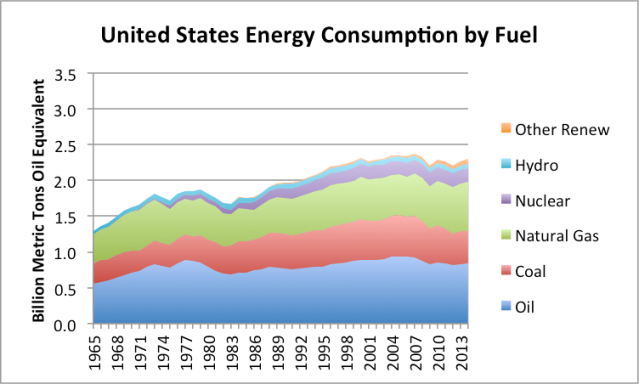

demand, and thus its consumption. The United States is often

portrayed as the bright ray of sunshine in a world with problems. Its

energy consumption is not growing very briskly either.

Figure 6. United States energy consumption by fuel, based on BP Statistical Review of World Energy 2014.

Figure 6. United States energy consumption by fuel, based on BP Statistical Review of World Energy 2014.

To

a significant extent, the US’s slowing energy consumption is

intended–more fuel-efficient cars, more fuel efficient lighting, and

better insulation. But part of this reduction in the growth in energy

consumption comes from outsourcing a portion of manufacturing to

countries around the world, including China. Regardless of cause, and

whether the result was intentional or not, the United States’

consumption is not growing very briskly. Figure 6 shows a small uptick

in the US’s energy consumption since 2012. This doesn’t do much to

offset slowing growth or outright declines in many other countries

around the world.

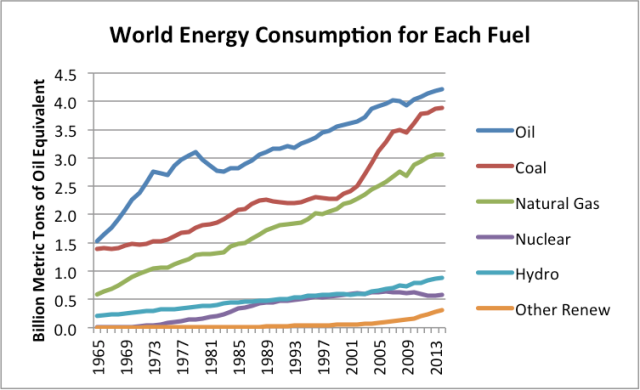

Slowing Growth in Demand for Almost All Fuels

We

can also look at world energy consumption by type of energy product.

Here we find that growth in consumption slowed in 2014 for nearly all

types of energy.

Figure 7. World energy consumption by part of the world, based on BP Statistical Review of World Energy 2015.

Figure 7. World energy consumption by part of the world, based on BP Statistical Review of World Energy 2015.

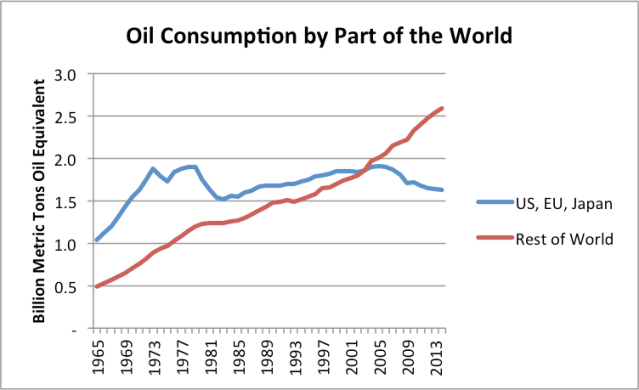

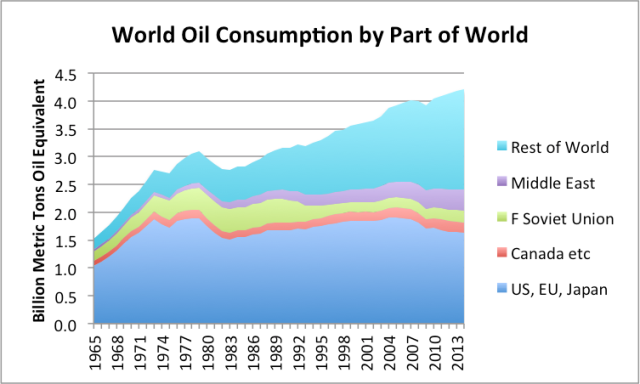

Looking

at oil separately (Figure 8), the data indicates that for the world in

total, oil consumption grew by 0.8% in 2014. This is lower than in the

previous three years (1.1%, 1.2%, and 1.1% growth rates).

Figure 8. Oil consumption by part of the world, based on BP Statistical Review of World Energy 2015.

Figure 8. Oil consumption by part of the world, based on BP Statistical Review of World Energy 2015.

If

oil producers had planned for 2014 oil consumption based on the recent

past growth in oil consumption growth, they would have overshot by about

1,484 million tons of oil equivalent (MTOE), or about 324,000 barrels

per day. If this entire drop in oil consumption came in the second half

of 2014, the overshoot would have been about 648,000 barrels per day

during that period. Thus, the mismatch we are have recently been seeing

between oil consumption and supply appears to be partly related to

falling demand, based on BP’s data.

(Note: The “oil” being

discussed is inclusive of biofuels and natural gas liquids. I am using

MTOE because MTOE puts all fuels on an energy equivalent basis. A barrel

is a volume measure. Growth in barrels will be slightly different from

that in MTOE because of the changing mix of liquid fuels.)

We can also look at oil consumption for the EU, EU, and Japan, compared to all of the rest of the world.

While

the rest of the world is still increasing its growth in oil

consumption, its rate of increase is falling–from 2.3% in 2012, to 1.6%

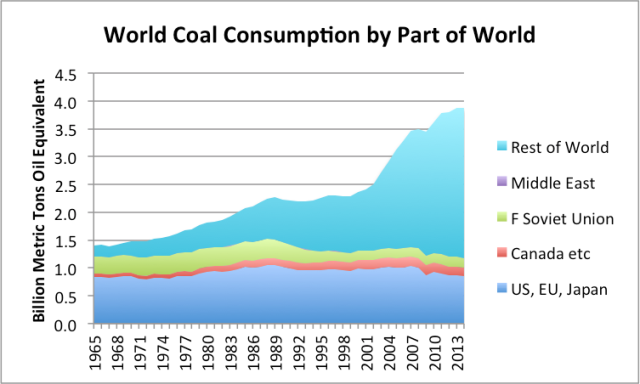

in 2013, to 1.3% in 2014. Figure 10 showing world coal consumption

is truly amazing. Huge growth in coal use took place as globalization

spread. Carbon taxes in some countries (but not others) further tended

to push manufacturing to coal-intensive manufacturing locations, such as

China and India.

Figure 10. World coal consumption by part of the world, based on BP Statistical Review of World Energy 2015.

Figure 10. World coal consumption by part of the world, based on BP Statistical Review of World Energy 2015.

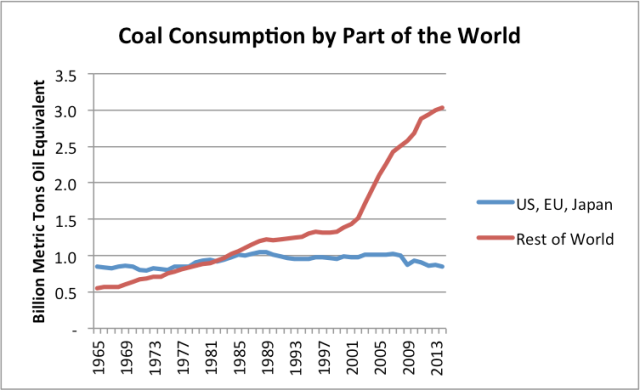

Looking

at the two parts of the world separately (Figure 11), we see that in

the last three years, growth in coal consumption outside of US, EU, and

Japan, has tapered down. This is similar to the result for world

consumption of coal in total (Figure 10).

Figure

11. Coal consumption for the US, EU, and Japan separately from the Rest

of the World, based on BP Statistical Review of World Energy data.

Figure

11. Coal consumption for the US, EU, and Japan separately from the Rest

of the World, based on BP Statistical Review of World Energy data.

Another way of looking at fuels is in a chart that compares consumption of the various fuels side by side (Figure 12).

Figure 12. World energy consumption by fuel, showing each fuel separately, based on BP Statistical Review of World Energy 2015.

Figure 12. World energy consumption by fuel, showing each fuel separately, based on BP Statistical Review of World Energy 2015.

Consumption

of oil, coal and natural gas are all moving on tracks that are in some

sense parallel. In fact, coal and natural gas consumption have recently

tapered more than oil consumption. World oil consumption grew by 0.8% in

2014; coal and natural gas consumption each grew by 0.4% in 2014.

The

other three fuels are smaller. Hydroelectric had relatively slow growth

in 2014. Its growth was only 2.0%, compared to a recent average of as

much as 3.5%. Even with this slow growth, it raised hydroelectric energy

consumption to 6.8% of world energy supply. Nuclear electricity

grew by 1.8%. This is actually a fairly large percentage gain compared

to the recent shrinkage that has been taking place.

Other

renewables continued to grow, but not as rapidly as in the past. The

growth rate of this grouping was 12.0%, (compared to 22.4% in 2011,

18.1% in 2012, 16.5% in 2013). With the falling percentage growth rate,

growth is more or less “linear”–similar amounts were added each year,

rather than similar percentages. With recent growth, other renewables

amounted to 2.5% of total world energy consumption in 2014.

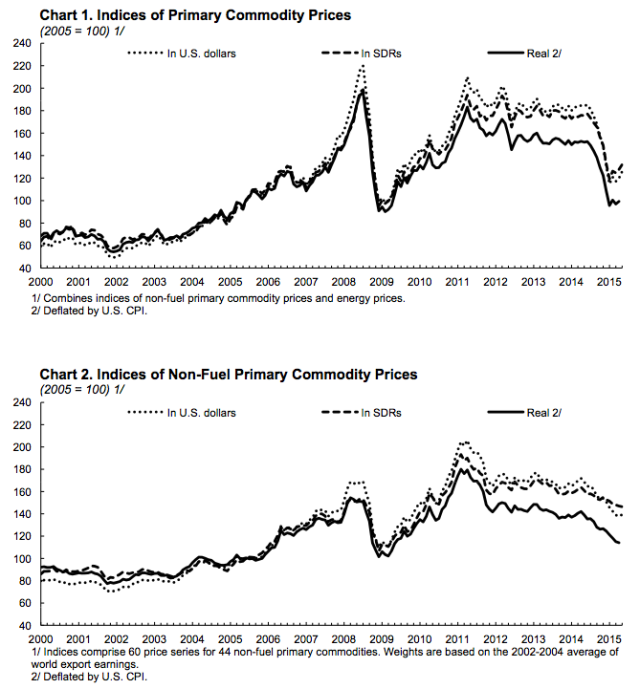

Falling Consumption Is What We Would Expect with Lower Inflation-Adjusted Prices

People

buy goods that they want or need, with one caveat: they don’t buy what

they cannot afford. To a significant extent affordability is based on

wages (or income levels for governments or businesses). It can also

reflect the availability of credit. We know that commodity prices

of many kinds (energy, food, metals of many kinds) have been have

generally been falling, on an inflation adjusted basis, for the past

four years. Figure 13 shows a graph prepared by the International Monetary Fund of trends in commodity prices.

It

stands to reason that if prices of commodities are low, while the

general trend in the cost of producing these commodities is upward,

there will be erosion in the amount of these products that can be

purchased. (This occurs because prices are falling relative to the cost

of producing the goods.) If, prior to the drop in prices, consumption of

the commodity had been growing rapidly, lower prices are likely to lead

to a slower rate of consumption growth. If prices drop further or stay

depressed, an absolute drop in consumption may occur.

It seems to

me that the lower commodity prices we have been seeing over the past

four years (with a recent sharper drop for oil), likely reflect an

affordability problem. This affordability problem arises because for

most people, wages did not rise when energy prices rose, and the prices

of commodities in general rose in the early 2000s.

For a while,

the lack of affordability could be masked with a variety of programs:

economic stimulus, increasing debt and Quantitative Easing. Eventually

these programs reach their limits, and prices begin falling in

inflation-adjusted terms. Now we are at a point where prices of oil, coal, natural gas, and uranium are all low in inflation-adjusted terms, discouraging further investment.

Commodity Exporters–Will They Be Next to Be Hit with Lower Consumption?

If

the price of a commodity, say oil, is low, this is a problem for a

country that exports the commodity. The big issue is likely to be tax revenue.

Governments very often get a major share of their tax revenue from

taxing the profits of the companies that sell the commodities, such as

oil. If the price of oil, or other commodity that is exported drops,

then it will be difficult for the government to collect enough tax

revenue. There may be other effects as well. The company producing the

commodity may cut back its production. If this happens, the exporting

country is faced with another problem–laid-off workers without jobs.

This adds a second need for revenue: to pay benefits to laid-off

workers.

Many oil exporters currently subsidize energy and food

products for their citizens. If tax revenue is low, the amount of these

subsidies is likely to be reduced. With lower subsidies, citizens will

buy less, reducing world demand. This reduction in demand will tend to

reduce world oil (or other commodity) prices.

Even if subsidies

are not involved, lower tax revenue will very often affect the projects

an oil exporter can undertake. These projects might include building

roads, schools, or hospitals. With fewer projects, world demand for oil

and other commodities tends to drop. The concern I have now is

that with low oil prices, and low prices of other commodities, a number

of countries will have to cut back their programs, in order to balance

government budgets. If this happens, the effect on the world economy

could be quite large. To get an idea how large it might be, let’s look

again at Figure 1, recopied below.

Notice that the three “layers”

in the middle are all countries whose economies are fairly closely tied

to commodity exports. Arguably I could have included more countries in

this category–for example, other OPEC countries could be included in

this grouping. These countries are now in the “Rest of the World”

category. Adding more countries to this category would make the portion

of world consumption tied to countries depending on commodity exports

even greater.

Figure

1- Resource consumption by part of the world. Canada etc. groupng also

includes Norway, Australia, and South Africa. F Soviet Union means

Former Soviet Union. Middle East excludes Israel. Based on BP

Statistical Review of World Energy 2015 data.

Figure

1- Resource consumption by part of the world. Canada etc. groupng also

includes Norway, Australia, and South Africa. F Soviet Union means

Former Soviet Union. Middle East excludes Israel. Based on BP

Statistical Review of World Energy 2015 data.

My

concern is that low commodity prices will prove to be self-perpetuating,

because low commodity prices will adversely affect commodity exporters.

As these countries try to fix their own problems, their own demand for

commodities will drop, and this will affect world commodity prices. The

total amount of commodities used by exporters is quite large. It is even

larger when oil is considered by itself (see Figure 8 above).

In my view, the collapse of the Soviet Union in 1991 occurred indirectly as a result of low oil prices in the late 1980s.

A person can see from Figure 1 how much the energy consumption of the

Former Soviet Union fell after 1991. Of course, in such a situation

exports may fall more than consumption, leading to a rise in oil prices.

Ultimately, the issue becomes whether a world economy can adapt to

falling oil supply, caused by the collapse of some oil exporters.

Our Economy Has No Reverse Gear

None

of the issues I raise would be a problem, if our economy had a reverse

gear–in other words, if it could shrink as well as grow. There are a

number of things that go wrong if an economy tries to shrink:

- Businesses find themselves with more factories than they need. They need to lay off workers and sell buildings. Profits are likely to fall. Loan covenants may be breached. There is little incentive to invest in new factories or stores.

- There are fewer jobs available, in comparison to the number of available workers. Many drop out of the labor force or become unemployed. Wages of non-elite workers tend to stagnate, reflecting the oversupply situation.

- The government finds it necessary to pay more benefits to the unemployed. At the same time, the government’s ability to collect taxes falls, because of the poor condition of businesses and workers.

- Businesses in poor financial condition and workers who have been laid off tend to default on loans. This tends to put banks into poor financial condition.

- The number of elderly and disabled tends to grow, even as the working population stagnates or falls, making the funding of pensions increasingly difficult.

- Resale prices of homes tend to drop because there are not enough buyers.

Many

have focused on a single problem area–for example, fractional reserve

banking–as being the problem preventing the economy from shrinking. It

seems to me that this is not really the issue. The problem is much more

fundamental. We live in a networked economy; a networked economy has

only two directions available to it: (1) growth and (2) recession, which

can lead to collapse.

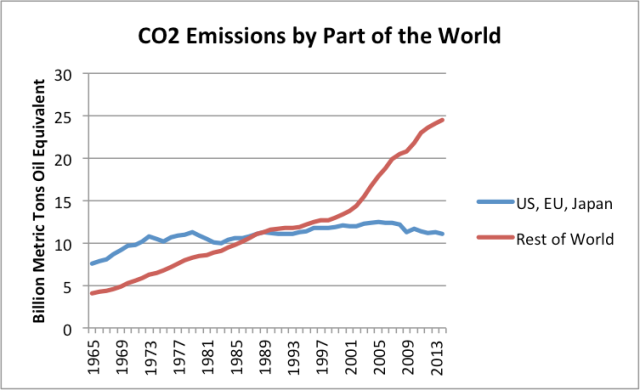

Conclusion

What we

seem to

be seeing is an end to the boost that globalization gave to the

world economy. Thus, world economic growth is slowing, and because of

this slowed economic growth, demand for energy products is slowing. This

globalization was encouraged by the Kyoto Protocol (1997). The protocol

aimed to reduce carbon emissions, but because it inadvertently

encouraged globalization, it tended to have the opposite effect. Adding

China to the World Trade Organization in 2001 further encouraged

globalization. CO2 emissions tended to grow more rapidly after those

dates.

Figure 14. World CO2 emissions from fossil fuels, based on data from BP Statistical Review of World Energy 2015.

Figure 14. World CO2 emissions from fossil fuels, based on data from BP Statistical Review of World Energy 2015.

Now

growth in fuel use is slowing around the world. Virtually all types of

fuel are affected, as are many parts of the world. The slowing growth is

associated with low fuel prices, and thus slowing demand for fuel. This

is what we would expect, if the world is running into affordability

problems, ultimately related to fuel prices rising faster than wages.

Globalization

brings huge advantages, in the form of access to cheap energy products

still in the ground. From the point of view of businesses, there is also

the possibility of access to cheap labor and access to new markets for

selling their goods. For long-industrialized countries, globalization

also represents a workaround to inadequate local energy supplies. The one problem with globalization is that it is not a permanent solution. This happens for several reasons:

- A great deal of debt is needed for the new operations. At some point, this debt starts reaching limits.

- Diminishing returns leads to higher cost of energy products. For example, later coal may need to come from more distant locations, adding to costs.

- Wages in the newly globalized area tend to rise, negating some of the initial benefit of low wages.

- Wages of workers in the area developed prior to globalization tend to fall because of competition with workers from parts of the world getting lower pay.

- Pollution becomes an increasing problem in the newly globalized part of the world. China is especially concerned about this problem.

- Eventually, more than enough factory space is built, and more than enough housing is built.

- Demand for energy products (in terms of what workers around the world can afford) cannot keep up with production, in part because wages of many workers lag thanks to competition with low-paid workers in less-advanced countries.

It seems to me that we are reaching the limits

of globalization now. This is why prices of commodities have fallen.

With falling prices comes lower total consumption. Many economies are

gradually moving into recession–this is what the low prices and falling

rates of energy growth really mean. It is quite possible that at

some point in the not too distant future, demand (and prices) will fall

further. We then will be dealing with severe worldwide recession.

In

my view, low prices and low demand for commodities are what we should

expect, as we reach limits of a finite world. There is widespread belief

that as we reach limits, prices will rise, and energy products will

become scarce. I don’t think that this combination can happen for very

long in a networked economy. High energy prices tend to lead to

recession, bringing down prices. Low wages and slow growth in debt also

tend to bring down prices. A networked economy can work in ways that

does not match our intuition; this is why many researchers fail to see

understand the nature of the problem we are facing.

http://www.theenergycollective.com/gail-tverberg/2242642/bp-data-suggests-we-are-reaching-peak-energy-demand