When forecasting how much oil will be available in future years, a standard approach seems to be the following:

- Figure out how much GDP growth the researcher hopes to have in the future.

- “Work backward” to see how much oil is needed, based on how much oil was used for a given level of GDP in the past. Adjust this amount for hoped-for efficiency gains and transfers to other fuel uses.

- Verify that there is actually enough oil available to support this level of growth in oil consumption.

In

fact, this seems to be the approach used by most forecasting agencies,

including EIA, IEA and BP. It seems to me that this approach has a

fundamental flaw. It doesn’t consider the possibility of continued low

oil prices and the impact that these low oil prices are likely to have

on future oil production. Hoped-for future GDP growth may not be

possible if oil prices, as well as other commodity prices, remain low.

Future Oil Resources Seem to Be More Than Adequate

It is easy to get the idea that we have a great deal of oil resources in the ground. For example, if we start with BP Statistical Review of World Energy,

we see that reported oil reserves at the end of 2013 were 1,687.9

billion barrels. This corresponds to 53.3 years of oil production at

2013 production levels.

If we look at the United States Geological Services 2012 report for one big grouping–undiscovered conventional oil resources for the world excluding the United States,

we get a “mean” estimate of 565 billion barrels. This corresponds to

another 17.8 years of production at the 2013 level of oil production.

Combining these two estimates gets us to a total of 71.1 years of future

production. Furthermore, we haven’t even begun to consider oil that may

be available by fracking that is not considered in current reserves. We

also haven’t considered oil that might be available from very heavy oil

deposits that is not in current reserves. These would theoretically add

additional large amounts.

Given these large amounts of

theoretically available oil, it is not surprising that forecasters use

the approach they do. There appears to be no need to cut back forecasts

to reflect inadequate future oil supply, as long as we can really

extract oil that seems to be available.

Why We Can’t Count on Oil Prices Rising Indefinitely

There

is clearly a huge amount of oil available with current technology, if

high cost is no problem. Without cost constraints, fracking can be used

in many more areas of the world than it is used today. If more water is

needed for fracking than is available, and price is no object, we can

desalinate seawater, or pump water uphill for hundreds of miles.

If

high cost is no problem, we can extract very heavy oil in many deposits

around the world using energy intensive heating approaches similar to

those used in the Canadian oil sands. We can also create gasoline using a

coal-to-liquids approach. Here again, we may need to work around water

shortages using very high cost methods. The amount of available

future oil is likely to be much lower if real-world price constraints

are considered. There are at least two reasons why oil prices can’t rise

indefinitely:

- Any time oil prices rise, economies that use a high proportion of oil in their energy mix experience financial problems. For example, countries that get a lot of their revenue from tourism seem to be vulnerable to high oil prices, because high oil prices raise the cost of airline travel. Also, if any oil is used for making electricity, its high cost makes it expensive to manufacture goods for export.

- When oil prices rise, workers find that the cost of food tends to rise, as does the cost of commuting. To offset these rising expenses, workers cut back on discretionary spending, such as going to restaurants, going on long-distance vacations, and buying more expensive homes. These spending cutbacks adversely affect the economy.

The combination of these two effects tends to lead

to recession, and recession tends to bring commodity prices in general

down. The result is oil prices that cannot rise indefinitely. The oil

extraction limit becomes a price limit related to recessionary impacts.

The

cost of oil is currently in the $60 per barrel range. It is not even

clear that oil prices can rise back to the $100 per barrel level without

causing recession in many counties. In fact, the demand for many things is low, including labor and capital.

Why should the price of oil rise, if the overall economy is not

generating enough demand for goods of all kinds, including oil?

Oil Companies Can Report a Wide Range of Oil Prices Needed for Profitability

The

discussion of required oil prices is confusing because there are many

different ways to compute oil prices needed for profitability. Companies

make use of this fact in choosing information to report to the press.

They want to make their situations look as favorable as possible,

because they do not want to frighten bondholders and prospective stock

buyers. This usually means reporting as low a needed price for

profitability as possible.

Oil prices can be computed on any of the following bases (arranged roughly from lowest to highest):

- (a) The “going forward” cost of extracting oil from wells that are already in place, excluding fixed expenses that the company would incur anyhow. This cost is likely to be very low, likely less than $30 barrel.

- (b) The cost of drilling new “infill” wells in existing fields, excluding the overhead expenses the company would incur anyhow.

- (c) The cost of opening up a new oil field and drilling new wells, excluding the overhead expenses the company would incur anyhow.

- (d) Add to (c), overhead expenses (but not including taxes paid to governments, dividends to policyholders, and interest on borrowed funds).

- (e) Add to (d) amounts paid to government, dividends to policyholders, and interest on borrowed funds.

- (f) The price required so that the oil company has sufficient cash flow so that it doesn’t need to keep taking on more debt. Instead, it can earn a reasonable profit (and from this pay dividends), and still have suffient funds left for “Exploration & Development” of new fields to offset declines in production in existing fields. It can also pay governments the high taxes they require, and pay other ongoing expenses. Thus, the system can continue to operate, without assistance from other sources.

I would argue that if we actually want to extract a

large share of technically recoverable oil, we need oil prices up at

this top level–a level at which companies are making a reasonable profit

on a cash flow basis, so that they don’t have to go further and further

into debt. If they are getting less than they really need, they will

send drilling rigs home. They will use available funds to buy back their

own shares, rather than spending as much money as is required to

develop new fields to offset declines in existing fields.

Required Oil Prices

Many

people believe that low prices started in late-2004, when oil prices

dropped below the $100 barrel level. If we look back, we find that there

was a problem as early as 2013, when oil prices were over $100 per

barrel. Oil companies were then complaining about not making a profit on

a cash flow basis–in other words, the highest price basis listed above.

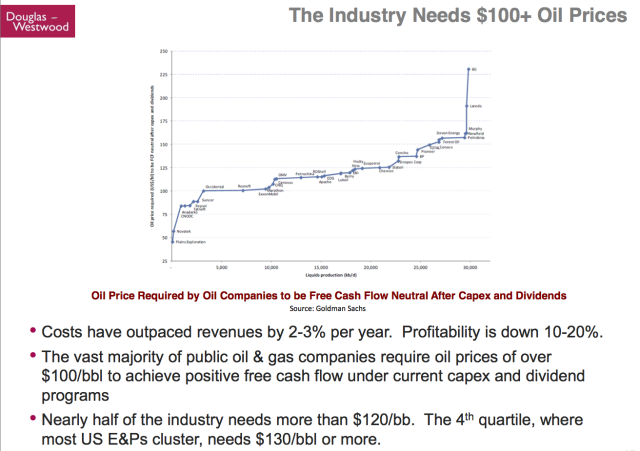

My February 2014 post called Beginning of the End? Oil Companies Cut Back on Spending (relating to a presentation by Steve Kopits) talks

about oil companies already doing poorly on a cash flow basis. Many

needed to borrow money in order to have sufficient funds to pay both

dividends and “Exploration & Production” expenses related to

potential new fields. Figure 1 is a slide by Kopits showing prices

required for selected individual companies to be cash flow neutral:

Figure 1.

The

problem back in 2013 was that $100 per barrel was not sufficient for

most companies to be profitable on a cash flow basis. At that time,

Figure 1 indicates that a price of over $130 per barrel was needed for

many US companies to be profitable on that basis. Russian companies

needed prices in the $100 to $125 range, while the Chinese companies

PetroChina and Sinopec needed prices in the $115 to $130 per barrel

range. The Brazilian company Petrobas needed a price over $150 per

barrel to be cash flow neutral.

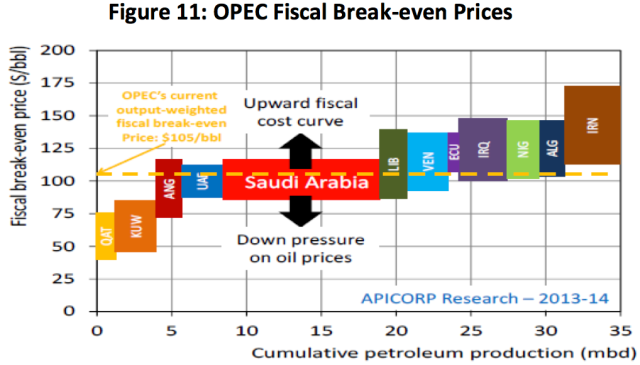

Kopits doesn’t show required

prices for OPEC countries to be cash flow neutral, but similar price

estimates (required funding including budgeted tax amounts) are

available from Arab Petroleum Investments Corporation (Figure 2, below).

Figure 2. Estimate of OPEC break-even oil prices, including tax requirements by parent countries, from Arab Petroleum Investments Corporation.

Based

on this exhibit, OPEC costs are generally over $100 per barrel. In

other words, OPEC costs are not too different from non-OPEC costs, when

all types of expenses, including taxes, are included. As more oil

is extracted, the tendency is for costs to rise. Figure 3, also from the

Kopits’ presentation, shows a rapid escalation in some types of costs

after 1999. This is what we would expect when we reach the end of

readily available “cheap to extract” oil and move to more

expensive-to-extract unconventional types of oil.

Figure 3. Figure by Steve Kopits of Douglas Westwood showing trends in world oil exploration and production costs per barrel.

What

prices do we need on a going-forward basis, to keep the oil extraction

system operating on a long-term basis? I would argue that we need a

price of at least $130 now in 2015. In the future, this price needs to

rise to higher and higher levels, perhaps moving up quite quickly as we

move to more-expensive-to-extract resources.

Is it really

necessary to include tax revenues in these calculations? I would argue

that the inclusion of taxes is especially important for oil exporting

nations. Most of these countries depend heavily on oil taxes to provide

funds to operate programs providing food and jobs. As the quantity of

oil that they can extract depletes, and as the population of these

countries rises, the per-barrel amount of revenue required to fund these

government programs is likely to increase. If we want to have a

reasonable chance of stability within these countries (so that exports

can continue), then we need to expect that the tax loads of companies in

oil exporting nations will increase in the future.

Also, if there

is any plan to subsidize “renewables,” funds to make this possible need

to come from somewhere. Indirectly, these funds are available because

of surpluses made possible by the fossil fuel industry. Thus taxes from

the fossil fuel industry might be considered a way of subsidizing

renewables.

Why Production Doesn’t Quickly Reset to Match Prices

Do

we really have a problem with oil prices, if oil production hasn’t

dropped quickly in response to low prices? I think we do still have a

problem. One reason why oil production doesn’t quickly reset to

match prices is related to many different ways of reporting oil

extraction costs, mentioned above. A company may not be making money

when all costs are included, but it is making money on a cash flow basis

if “sunk costs” are ignored.

Another reason why oil production

doesn’t quickly reset to match prices is the fact that oil is the

lifeblood of companies that produce it. “Cutting back” means laying off

trained workers. If these workers are laid off, companies will find it

nearly impossible to rehire the same workers later. The workers have

families to support; they will need to find work, even if it is in other

industries. Companies will need to train new workers from scratch.

Thus, companies will do almost anything to keep employees, no matter how

low prices drop on a temporary basis.

A similar issue applies to

equipment used in oil operations. Drilling equipment that is not used

will deteriorate over time and may not be usable in the future. A USA

Today article talks about auctions of equipment used in the oil industry. This equipment is likely to be permanently lost to the oil industry, making it hard to ramp back up again.

If

a company is a government owned company in an oil-exporting nation,

there is an even greater interest in keeping the company operating. Very

often, oil is the backbone of the entire country’s economy; most tax

revenue comes from oil and gas companies. There is no real option of

substantially cutting back operations, because tax funds and jobs are

badly needed by the economy. Civil unrest could be a problem without tax

revenue. In the short run, some countries, including Saudi Arabia, have

reserve funds set aside to cover a rainy day. But these run out, so it

is important to maintain market share.

There are additional reasons why oil production stays high in the short term:

- Some companies have contracts in the futures market that cushion price fluctuations, so they may not directly “feel” the impact of low prices. Because of this, they may not react quickly.

- Oil companies will very often have debt obligations that they need to meet, and need cash flow to keep meet them. Any cash flow, even if the price covers only a bit more in the direct cost of extraction, is helpful.

- Large amounts of equity funding have been available, even for companies issuing “junk bonds.” Companies that would otherwise be reaching debt limits have been able to issue large amounts of stock instead. Bloomberg reports that in the first quarter, $8 billion in stock was issued, which is a record.

All

of these considerations have allowed production to continue

temporarily, but are unlikely to be long-term solutions. In the long

run, we know that we are likely to see problems such as defaults on junk

rated bonds of oil companies. Futures contracts guaranteeing high

prices eventually run out. Also, if prices remain low, government

programs of oil exporting countries may need to be cut back, leading to

unrest by citizens. Regardless of what is happening in the

short-term, it is clear that eventually production will drop, quite

possibly permanently, unless oil prices rise substantially.

Why are Oil Prices so Low?

I see two reasons for low oil prices:

- Debt is now not rising fast enough, because debt levels are reaching limits. Increases in debt levels tend to hold up commodity prices because increasing amounts of debt allow consumers to buy additional cars, homes, factories and other goods, thus creating “demand” for oil and other commodities. At some point, debt limits are reached. This can happen because a growth spurt is slowing, as in China, or because governments are reaching limits on the ratio of debt to GDP that they can carry. When debt levels stop rising rapidly, the debt “pump” that has been holding up prices in the past disappears, and commodity prices tend to stay at a lower level.

- The wages of ordinary workers are lagging behind. If a young person cannot find a good paying job (or owes too much on college loans), he most likely will live with his parents longer, delaying the purchase of a house and car. If a family discovers that the cost of day care for children plus the cost of commuting is more than the wages of the lower-earning parent, the lower-earning parent may choose not to work. A household with only one employed worker is less likely to buy a house or a second car than a two-worker household. These kinds of responses to low wages tend to hold down “demand” for goods made with commodities. Thus, affordability issues (or low demand related to affordability) tends to hold down the prices of commodities.

The

problem of lagging wages of ordinary workers is a very old one. The

problem occurs whenever there are issues with diminishing returns. For

example, when population reaches a level where there are too many

farmers for available land, the average size of plot for each farmer

tends to decrease. Each farmer tends to produce less, because of the

smaller size of plot available. If each farmer is paid for what he

produces, his wages will drop.

We are reaching the same problem

today with oil. We continue to produce increasing amounts of oil, but

doing so requires increasing numbers of workers and increasing amounts

of resources of other types (including fresh water, steel, sand for

fracking, and energy products). Workers are on average producing less

oil per hour worked. In theory, they should be paid less, because the

value of oil is determined by what the oil can do (how far it can move a

vehicle), not how much labor was required to produce the oil.

The same problem is occurring in other areas of the economy,

including natural gas production, coal production, electricity

production, medicine, and higher education. At some point, we find the

economy as a whole becoming less efficient, rather than more efficient,

because of diminishing returns.

We know from Peter Turchin and Surgey Nefedov’s book, Secular Cycles, that

low wages of common workers were frequently a major contributing factor

to collapses in pre-fossil fuel days. With lower wages, workers were

not able to buy adequate food, allowing epidemics to take hold. Also,

governments could not collect adequate taxes from the large number of

low-earning workers, leading to governmental financial problems. A

person wonders whether today’s economy is reaching a similar situation.

Will low wage growth of common workers hold down future GDP growth, or

even lead to collapse?

Are the Projections of EIA, IEA, BP, and all the Others Right?

Perhaps

these projections would be reasonable, if oil prices could immediately

bounce to $130 per barrel and could continue to inflate in the years

ahead. If, on the other hand, low oil prices are really being

caused by lagging wages of ordinary workers and the failure of debt

levels to keep rising, then I don’t think we can expect oil prices to

reach these lofty levels. Instead, we can expect oil production to fall

because of low prices.

The amount of oil available at $60 per

barrel seems to be quite low. Perhaps a little low-priced oil would be

available from Kuwait and Qatar at that price, but not much else. Some

additional oil might be obtained, if governments of non-oil exporters

(such as the USA and China) choose to cut back their tax levels on oil

companies. Even with the additional oil made possible by lower taxes,

total oil supply would still be far less than needed to run today’s

world economy.

The world economy would need to contract greatly in

order to shrink down to the oil available. Such shrinkage might be

accomplished by a cutback in trade and loss of jobs. Debt defaults would

likely be another feature of the new smaller economy. Such a scenario

would explain how future oil production may deviate significantly from

the forecasts of EIA, IEA, and BP.

http://theenergycollective.com/gail-tverberg/2238406/why-eia-iea-and-bp-oil-forecasts-are-too-high