by Debra Fiakas CFA

Two months ago GreenShift

Corporation (GERS:

OTC) ambitiously promised to introduce by the end of 2012 an

improved corn oil extraction system. The company has

developed technology to extract oil more from corn used as feedstock

by ethanol producers. GreenShift claims its first system is

recovering an incremental 0.8 pounds of oil per bushel of corn in

current installations. The new system - called

COES II - is expected to increase the oil yields

to 1.3 pounds - a 62% improvement that will put more

profits in ethanol producers’ pockets.

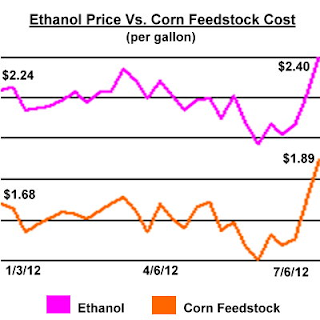

Incremental profits can make a difference in the economics of ethanol plants that are squeezed between the costs of natural gas required to fuel to the distillation process and corn feedstock on the one side and ethanol selling prices on the other. Recently ethanol producers have benefited from low natural gas prices. However, corn selling prices have spiked in the last couple of weeks on the apparent loss in corn crop due to the 2012 drought. Any hope of lower corn feedstock prices this fall have been pulverized to dust right along with the huge corn plantings farmers had pledged at the 2012 season start.

Those profit-sapping conditions might seem favorable for selling GreenShift’s performance enhancing technology. However, the system requires capital that some ethanol producers might find hard to come by. Last year Valero Energy (VLO: NYSE) announced it would be installing corn oil extraction equipment at four of its plants by the end of 2012. Valero plans to sell the higher-value corn oil into animal feed markets. It expects to cover the capital expenditure with incremental earnings within two years.

A short payback period may still not be enough to ensure adoption of corn extraction technology. Besides Valero, the largest ethanol producers - Archer Daniels Midland (ADM: NYSE); POET of Sioux Falls, SD;; GreenPlains Renewable Energy (GPRE: Nasdaq); and Flint Hills Resources, Inc. of Michigan - have balances sheets of varying strengths and can easily pay for the equipment. However, smaller ethanol producers such as Pacific Ethanol (PEIX: Nasdaq) or privately-held Patriot Renewable Fuels may not have ready access to resources under current capital market conditions.

Even after ethanol producers gather together enough capital to buy the equipment Greenshift faces a bit of competition. Those four corn oil extraction systems Valero is installing this year are coming from ICM, Inc., which offers a menu of technologies to ethanol producers and grain processors. GEA Westfalia Separator (a subsidiary of GEA Group AG) specializes in liquids separation across a variety of industries. Likewise Flottwegg AG sells equipment for corn oil extraction among a selection of equipment for the process industries. Greenshift is sensitive to the competition and has been in legal tussles with all three companies since the U.S. Patent Office awarded GreenShift a patent for its COES I system in 2009.

A legal victory may come too late for GreenShift. At the end of March 2012, the company reported less than a million dollars in cash on its balance sheet. GreenShift is not profitable and has an accumulated deficit of $161.9 million. Its operations appear to need approximately $500,000 in cash support per quarter. GreenShift has indicated it plans a capital raise this year to make that bridge to the more competitive COES II system.

GreenShift shares are quoted near a penny on an over-the-counter listing service. It is an illiquid stock and often has no quoted bid or ask price. Any investor taking a position in the stock on the new product introduction should do so with their eyes wide open and a willingness to risk all. On top of capitalization issues, both target markets and capital markets present challenges for GreenShift.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. GERS is included in the Ethanol Group of our Beach Boys Index for alternative energy sources.

|

| Source: Chicago Board of

Exchange |

Incremental profits can make a difference in the economics of ethanol plants that are squeezed between the costs of natural gas required to fuel to the distillation process and corn feedstock on the one side and ethanol selling prices on the other. Recently ethanol producers have benefited from low natural gas prices. However, corn selling prices have spiked in the last couple of weeks on the apparent loss in corn crop due to the 2012 drought. Any hope of lower corn feedstock prices this fall have been pulverized to dust right along with the huge corn plantings farmers had pledged at the 2012 season start.

Those profit-sapping conditions might seem favorable for selling GreenShift’s performance enhancing technology. However, the system requires capital that some ethanol producers might find hard to come by. Last year Valero Energy (VLO: NYSE) announced it would be installing corn oil extraction equipment at four of its plants by the end of 2012. Valero plans to sell the higher-value corn oil into animal feed markets. It expects to cover the capital expenditure with incremental earnings within two years.

A short payback period may still not be enough to ensure adoption of corn extraction technology. Besides Valero, the largest ethanol producers - Archer Daniels Midland (ADM: NYSE); POET of Sioux Falls, SD;; GreenPlains Renewable Energy (GPRE: Nasdaq); and Flint Hills Resources, Inc. of Michigan - have balances sheets of varying strengths and can easily pay for the equipment. However, smaller ethanol producers such as Pacific Ethanol (PEIX: Nasdaq) or privately-held Patriot Renewable Fuels may not have ready access to resources under current capital market conditions.

Even after ethanol producers gather together enough capital to buy the equipment Greenshift faces a bit of competition. Those four corn oil extraction systems Valero is installing this year are coming from ICM, Inc., which offers a menu of technologies to ethanol producers and grain processors. GEA Westfalia Separator (a subsidiary of GEA Group AG) specializes in liquids separation across a variety of industries. Likewise Flottwegg AG sells equipment for corn oil extraction among a selection of equipment for the process industries. Greenshift is sensitive to the competition and has been in legal tussles with all three companies since the U.S. Patent Office awarded GreenShift a patent for its COES I system in 2009.

A legal victory may come too late for GreenShift. At the end of March 2012, the company reported less than a million dollars in cash on its balance sheet. GreenShift is not profitable and has an accumulated deficit of $161.9 million. Its operations appear to need approximately $500,000 in cash support per quarter. GreenShift has indicated it plans a capital raise this year to make that bridge to the more competitive COES II system.

GreenShift shares are quoted near a penny on an over-the-counter listing service. It is an illiquid stock and often has no quoted bid or ask price. Any investor taking a position in the stock on the new product introduction should do so with their eyes wide open and a willingness to risk all. On top of capitalization issues, both target markets and capital markets present challenges for GreenShift.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. GERS is included in the Ethanol Group of our Beach Boys Index for alternative energy sources.

http://www.altenergystocks.com/archives/2012/07/greenshifts_new_extraction_technology_a_62_improvement_but_challenges_abound_1.html