What is the real story of energy and the economy? We hear two

predominant energy stories. One is the story economists tell: The

economy can grow forever; energy shortages will have no impact on the

economy. We can simply substitute other forms of energy, or do without.

Another

version of the energy and the economy story is the view of many who

believe in the “Peak Oil” theory. According to this view, oil supply can

decrease with only a minor impact on the economy. The economy will

continue along as before, except with higher prices. These higher prices

encourage the production of alternatives, such wind and solar. At this

point, it is not just peak oilers who endorse this view, but many others

as well.

In my view, the real story of energy and the economy is

much less favorable than either of these views. It is a story of oil

limits that will make themselves known as financial limits,

quite possibly in the near term—perhaps in as little time as a few

months or years. Our underlying problem is diminishing returns—it takes

more and more effort (hours of workers’ time and quantities of

resources), to produce essentially the same goods and services.

We

don’t measure our investment results with respect to the quantity of

end product produced (barrels of oil produced, liters of fresh water

produced, kilos of copper produced, or number of workers provided with

sufficient education to work in high tech industries), so we don’t

realize that we are becoming increasingly inefficient at producing

desired end products. See my post “How increased inefficiency explains falling oil prices.”

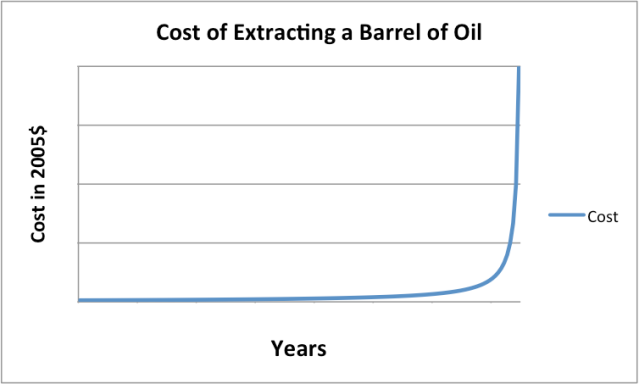

Figure 1. The way we would expect the cost of the extraction of energy supplies to rise, as finite supplies deplete.

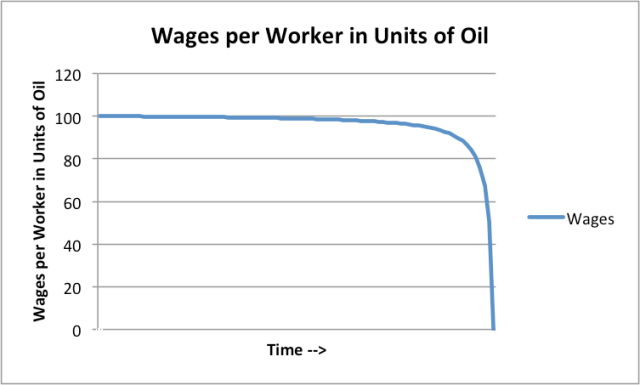

Wages,

viewed in terms of the product produced–oil in this case–can be

expected to decrease as well. This change isn’t evident in usual

efficiency statistics, because some of the workers are providing new

kinds of services, such as fracking services, that weren’t required

before.

Even

investment is becoming increasingly inefficient. It takes more and more

investment to extract a given quantity of oil or other energy product.

This investment needs to stay in place longer as well. The ultra-low

interest rates we have been experiencing reflect the poor returns

investments are now making.

The myth exists that prices of all of

the scarce goods and services will rise high and higher, as the economy

encounters scarcity. The real story, though, is that the

inflation-adjusted purchasing power of common workers is falling lower

and lower, especially in the United States, Europe, and Japan. Not only

can these workers afford to buy less, but they can also afford to borrow

less. This means that their ability to purchase expensive goods created

from commodities is falling. At some point, this lack of

purchasing power can be expected to affect the financial markets, and

the prices of many commodities can be expected to fall. In fact, this

already seems to be happening.

The likely impact of such a fall in

commodity prices is not good. If low oil prices cannot be “turned

around,” they will lead to debt defaults, and these debt defaults are

likely to lead to failing financial institutions. Failing financial

institutions have the potential to bring down the system, because it

becomes very difficult for businesses to continue if they are not

supported by a banking system that allows a company to pay its

employees. Workers also need the banking system to pay for goods and to

save for a “rainy day.” A big part of what has allowed the economy

to grow to the size it is today is increasing debt levels. These rising

debt levels play many roles:

- They make high-priced goods more affordable to consumers.

- They create greater demand for goods, allowing more end-product goods to be produced.

- They create more demand for commodities required to make end-product goods, allowing the price of these commodities to rise, so that more businesses have more incentive to create/extract these commodities.

At

some point, debt levels stop rising as fast as they have in the past

(because of a lack of growth in purchasing power because of diminishing

returns in investment), and the whole system tends to fall toward

collapse. We seem to have reached this point in the middle of 2014.

China was raising its total debt level rapidly up until the early part

of 2014, then suddenly moderated its growth in debt level in mid 2014.

At about the same time, the US scaled back and eliminated it program of

quantitative easing (QE). Oil prices dropped starting in mid-2014, at

the time debt levels started moderating. Other commodity prices started

falling as early as 2011, indicating likely affordability problems.

We

are now in the period when many people still believe everything is

going well. Oil prices and other commodity prices are low—what is “not

to like”? The answer is that the system in not at all

sustainable—profits of oil companies and other commodity businesses are

down, just as wages of common workers in developed countries are down in

inflation-adjusted terms. Companies are cutting back in investment in

oil production. Soon oil production will drop. With lower oil supply,

the economy will face huge challenges.

Many people believe that

oil prices can bounce back up again, but this really isn’t the case,

because of growing inefficiency related to limits we are reaching–the

need to use more advanced techniques to produce oil; the need for

desalination for water in some places; the need for more pollution

control equipment that doesn’t really increase the finished goods and

services we are producing but instead makes goods more expensive to

produce.

Each worker is, on average, producing less and less of

the finished goods we really need. Whether we like it or not, standards

of living will have to fall. The amount of debt workers can afford

decreases rather than increases. This new reality can be expected to

manifest itself in debt defaults and increasing financial system

problems.

Even if oil prices bounce back up again, it is doubtful

that shale oil drillers will be able to again borrow at a sufficiently

high rate to increase their production again—what lender will believe

that oil prices will remain high indefinitely?

The China Connection

I

have trying to put the real story of energy and the economy over a

period of years. Prof. Lianyong Feng of Petroleum University of China,

Beijing, hired me to put together a short course (eight sessions, each

lasting about 1.5 hours) on the nature of our current problems for

students majoring in “Energy Economics and Management.” The course would

be open to everyone choosing this major, including freshman, so I

needed to assume a fairly low level of background knowledge. Actual

attendees included a number of graduate students and faculty, attending

the course without credit.

I put together a series of lectures,

which I gave during the second half of March 2015. PDFs of my lectures

are also now available on my Presentations/Podcasts page.

These

lectures were videotaped by Prof. Feng’s staff, and I am in the process

of making You Tube Videos from them, in addition to the original MP4

format. (YouTube videos cannot be seen in China.) My current plan is to

give a brief discussion of these lectures, in future posts.

Following

the lecture series, I visited several places in China, to see how the

economic slowdown is playing out in China. This included visits to

Northwest China (Hohhot and Hardin), Northeast China (Daqing and

Harbin), and Southeast China (Wenzhou area). In Wenzhou, I visited three

different companies attempting to sell electrical equipment on the

world market.

From these visits, we could see how the world

economic slowdown is affecting China, and how China’s own slowdown in

debt growth is adding to the world slowdown. We could also see that the

slowdown has not yet run its course China–growth in housing continues,

even as the need for it seems to be slowing. College students are

finding it difficult to find high-paying jobs in oil and other commodity

sectors. The lack of growth in high-paying jobs will provide downward

pressure on housing prices as well.

http://theenergycollective.com/gail-tverberg/2217666/putting-real-story-energy-and-economy-together

No comments:

Post a Comment